Социалистам, любителям супер высоких налогов на богатых посвящается:

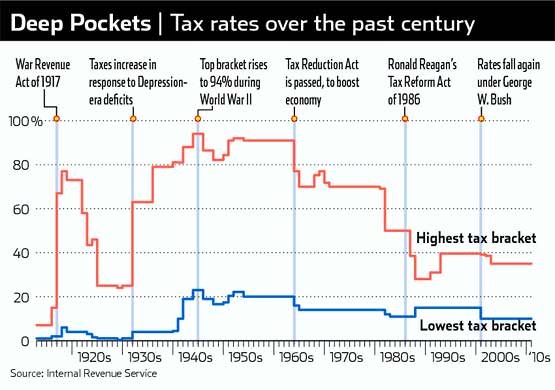

"There is a common misconception that high-income Americans are not paying much in taxes compared to what they used to. Proponents of this view often point to the 1950s, when the top federal income tax rate was 91 percent for most of the decade.[1] However, despite these high marginal rates, the top 1 percent of taxpayers in the 1950s only paid about 42 percent of their income in taxes. As a result, the tax burden on high-income households today is only slightly lower than what these households faced in the 1950s."

"There are a few reasons for the discrepancy between the 91 percent top marginal income tax rate and the 16.9 percent effective income tax rate of the 1950s.

The 91 percent bracket of 1950 only applied to households with income over $200,000 (or about $2 million in today’s dollars). Only a small number of taxpayers would have had enough income to fall into the top bracket – fewer than 10,000 households, according to an article in The Wall Street Journal. Many households in the top 1 percent in the 1950s probably did not fall into the 91 percent bracket to begin with.

Even among households that did fall into the 91 percent bracket, the majority of their income was not necessarily subject to that top bracket. After all, the 91 percent bracket only applied to income above $200,000, not to every single dollar earned by households.

Finally, it is very likely that the existence of a 91 percent bracket led to significant tax avoidance and lower reported income. There are many studies that show that, as marginal tax rates rise, income reported by taxpayers goes down. As a result, the existence of the 91 percent bracket did not necessarily lead to significantly higher revenue collections from the top 1 percent.

All in all, the idea that high-income Americans in the 1950s paid much more of their income in taxes should be abandoned. The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards."

https://taxfoundation.org/taxes-on-the-rich-1950s-not-high/

"There is a common misconception that high-income Americans are not paying much in taxes compared to what they used to. Proponents of this view often point to the 1950s, when the top federal income tax rate was 91 percent for most of the decade.[1] However, despite these high marginal rates, the top 1 percent of taxpayers in the 1950s only paid about 42 percent of their income in taxes. As a result, the tax burden on high-income households today is only slightly lower than what these households faced in the 1950s."

"There are a few reasons for the discrepancy between the 91 percent top marginal income tax rate and the 16.9 percent effective income tax rate of the 1950s.

The 91 percent bracket of 1950 only applied to households with income over $200,000 (or about $2 million in today’s dollars). Only a small number of taxpayers would have had enough income to fall into the top bracket – fewer than 10,000 households, according to an article in The Wall Street Journal. Many households in the top 1 percent in the 1950s probably did not fall into the 91 percent bracket to begin with.

Even among households that did fall into the 91 percent bracket, the majority of their income was not necessarily subject to that top bracket. After all, the 91 percent bracket only applied to income above $200,000, not to every single dollar earned by households.

Finally, it is very likely that the existence of a 91 percent bracket led to significant tax avoidance and lower reported income. There are many studies that show that, as marginal tax rates rise, income reported by taxpayers goes down. As a result, the existence of the 91 percent bracket did not necessarily lead to significantly higher revenue collections from the top 1 percent.

All in all, the idea that high-income Americans in the 1950s paid much more of their income in taxes should be abandoned. The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards."

https://taxfoundation.org/taxes-on-the-rich-1950s-not-high/

no subject

Date: 2019-11-16 05:25 am (UTC)no subject

Date: 2019-11-16 05:28 am (UTC)no subject

Date: 2019-11-18 04:12 pm (UTC)Ебут и раскулачивают, как всегда, средний класс.

no subject

Date: 2019-11-17 12:51 pm (UTC)где здесь социалисты, ау? вот если б вы с этим пошли в народ...но нет, не надо - всё равно ничего в их головах не изменится.

все аргументы/ обвинения/ символы веры, что мы слышим из уст социалистов - суть тактические ходы, требования момента. спорить с ними - уже упускать этот самый момент, потому что пока спорим и объясняем, почему глупость - у них уже указивка поменялась, и они с торжеством и полной верой кричат: поклёп!

no subject

Date: 2019-11-18 12:29 am (UTC)no subject

Date: 2019-11-20 02:56 am (UTC)paper by economists Gerald Auten and David Splinter, August 2018, suggests the spike in inequality Piketty and Saez have documented is a dramatic overestimate.

Auten and Splinter are serious, nonpartisan researchers (vox.com).

They used the same IRS tax data as Piketty, Saez, and Zucman. They found that the top 1%'s share of after-tax income rose from 8.4% in 1979 to 10.1% in 2015 - an increase less than a third as large.

"

Using individual tax returns, Piketty and Saez (2003) concluded that the top 1% income share at least doubled since 1960.

But these estimates are biased by tax base changes, missing income sources, and major social changes ..."

despite a decrease in the top federal individual income tax rate from 91 to 39.6% between 1960 and 2015, base-broadening reforms and the decreased use of tax shelters caused effective tax rates of the top 1% to increase from 14% to 24%.

Considering all taxes, effective tax rates of the top 1% increased while those of the bottom 90% fell

"

What looks on paper like a big increase in inequality in the 1980s and onward is really just money being shuffled around in response to Ronald Reagan-era changes to tax law. In 1980, the top individual income tax rate was 69.13%; by 1989, it had fallen by more than half, to 28%.

In the 1960s and 1970s, companies usually reinvested their profits rather than giving raises to executives - the high tax rates meant those salaries would be largely taxed away.

Reinvesting the money ultimately benefited rich people (Owning corporate shares was much rarer for middle-class people in the '60s and '70s before 401(k)s and IRAs).

After the tax cuts, companies started directing more money to raises. Rather than exploding actual inequality the Reagan tax changes mostly shifted money that used to go to rich people through stocks so that it instead went to rich people in the form of salary.

That looks like a big increase in the rich's slice of the pie on paper, because the higher salaries show up on tax returns, but the increasing value to shareholders doesn't, at least until the shares are sold.

Marriage rates, Auten and Splinter note, have fallen substantially over the last half-century. About 69% of tax filers were married in 1960, compared to 39% in 2015. But there's been basically no decline among the richest Americans.

That can bias results when you're comparing tax filers - which can either be single people, or married couples (including married couples where both people work)

последние данные показывают, что высокие налоги в 60-х и 70-х были куда менее эффективны в сокращении неравенства, чем мы привыкли думать.